If you care about high energy prices, fairness to low-income residents, honesty by governmental officials, and effective approaches to dealing with global warming, you should vote for Washington State Initiative 2117.

This initiative would repeal the Washington State Climate Commitment Act (CCA), which was approved by the Washington State legislature in 2021. This act requires businesses with emissions exceeding 25,000 metric tons of carbon dioxide per year to purchase allowances, which increases the cost of gasoline, natural gas, and other energy sources dependent on fossil fuels.

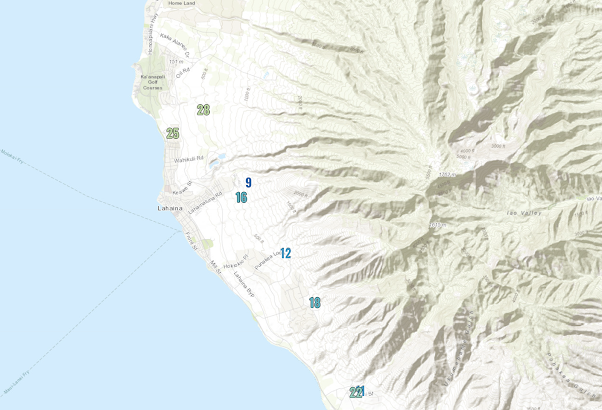

According to the best estimates of its impacts, this act has raised the price of gasoline by approximately 50 cents per gallon. A few months after the CCA went into effect, Washington State had the most expensive prices at the pump in the nation, while today we are number two to California, which also has such a tax (price per gallon is shown below, yellows are the highest prices).

The CCA also made natural gas more expensive, substantially raising the cost of heating, and since most items are moved by truck, it raised the prices of food and other necessities.

To illustrate, consider the price of natural gas used for heating in the Seattle Metro area, compared to the rest of the country. In 2020 and 2021, our gas prices were similar to the rest of the nation and in 2022 ours was less expensive, but after the CCA went into effect (January 1, 2023), our gas prices soared ahead of the rest of the nation.

Truth Should Matter

When Governor Inslee was pushing the CCA back in 2021 he stated:

His advisors had told him otherwise. To put it politely, our Governor was not being frank and honest with Washington State citizens. Good leadership including leveling with the public.

A Highly Regressive Energy Tax That Hurt Low-Income Folks the Most

There is a lot of talk about equity and fairness today. The CCA gas tax is highly regressive, with low-income folks experiencing a much higher percentage increase in their basic costs to survive and work.

Furthermore, wealthier folks can afford expensive electric cars and install charging stations in their homes. Charging is not so easy if you live in an apartment.

I got a real feeling for the opinions of working-class folks when I gave a talk to a group of grounds maintenance workers. When I mentioned my opposition to regressive gas taxes, the entire group started to applaud. Several of them came up to me afterward, telling me about their long commutes and the onerous costs of filling their gas tanks.

The CCA has collected enormous amounts of money during the last year and a half: over two billion dollars.

By the way, who do you think are the top two donors for the effort to stop I-2117? Two Microsoft billionaires: Steve Balmer and Bill Gates. I bet they don't worry about the cost of filling their gas tanks.

A History of Carbon-Tax Initiatives

I, like many others, am concerned about global warming. Back in 2016, I supported another carbon tax initiative (732) because it wasn't regressive, reducing the sales tax and returning substantial funds to low-income residents. The governor and climate activists were against it because they did not get any of the money.

Two years later, the Governor and the activists, pushed another carbon tax (I-1631), one in which special interests and pet projects got the cash. It was highly regressive and was soundly defeated (I was opposed to I-1631 because it was unfair to low-income folks).

The Climate Commitment Act (CCA) was passed in the state legislature in 2021.

A Very Ineffective Way to Fight Climate Change

Most of the cash from the CCA has been wasted on bureaucracy and inefficient pet projects, with little impact on carbon in the atmosphere. For example, the two biggest ticket items are:

• $429 million for public transit grants and projects,

including free transit for youth under 18

• $223 million for active transportation projects,

such as bike trails and safer sidewalks and

crosswalks

Free transit for youth is fine, as are safer sideways, but these efforts will do little to fight climate change. Very little funds were made available for fixing Washington State forests (e.g.,, thinning and prescribed burning). The carbon footprint of our state is still going up. Very little progress is being made.

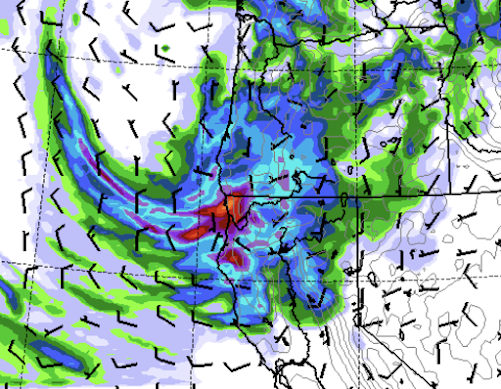

Consider the greenhouse gas emissions in Washington State provided by the Federal government that also includes gases besides CO2 (below). Virtually no downward trend through 2021. Very disappointing performance. Huge increase in 2022 due to improved reporting requirements. So you can't compare that year with the others.

The regressive CCA gas tax, which severely hurts low-income residents and has done little to reduce our carbon footprint, should be eliminated. We can do this by passing I-2117.

Then we need new state leadership and better approaches for dealing with climate change. Like a substantial increase in the use of nuclear energy. Like planning for additional dams and reservoirs. Like FINALLY getting serious about restoring our forests. And much more....